Can Southeast Asia’s finance sector fund a forest-beneficial long term? | Opinion | Eco-Business enterprise

Given that 2015, Singapore, Malaysia and Indonesia have established Nationally Identified Contributions (NDC) for assembly the Paris Agreement’s objectives to minimize carbon emissions and adapt to adverse local weather impacts.

Having said that, unresolved tensions amongst Forest Chance Commodity-pushed economic development and new environmental commitments have led to inconsistent forest administration, resulting in considerable forest loss.

Southeast Asia is household to 15 per cent of the world’s tropical rainforests, inhabited by close to 20 for each cent of world plant, animal, and marine species and is where up to 30 for every cent of the world’s natural carbon is stored.

However, trade-offs between conservation and financial improvement have place the region’s forests beneath critical threat.

Singapore, Malaysia, and Indonesia are central to FRC generation – which are merchandise or raw products, like timber and palm oil, whose generation contributes considerably to forest reduction and environmental degradation.

The production and trade of palm oil in Indonesia and Malaysia mostly accounts for the countries’ macroeconomic progress and contributes among 85-90 for each cent of world-wide palm oil manufacturing.

In the meantime, Singapore is a foundation of functions for numerous FRC providers, many thanks to the country’s strategic role as the region’s fiscal hub.

Southeast Asia’s monetary sector is uniquely positioned to speed up modifications in environmental motion by way of their lending portfolios offered the substantial quantity of funds they offer.

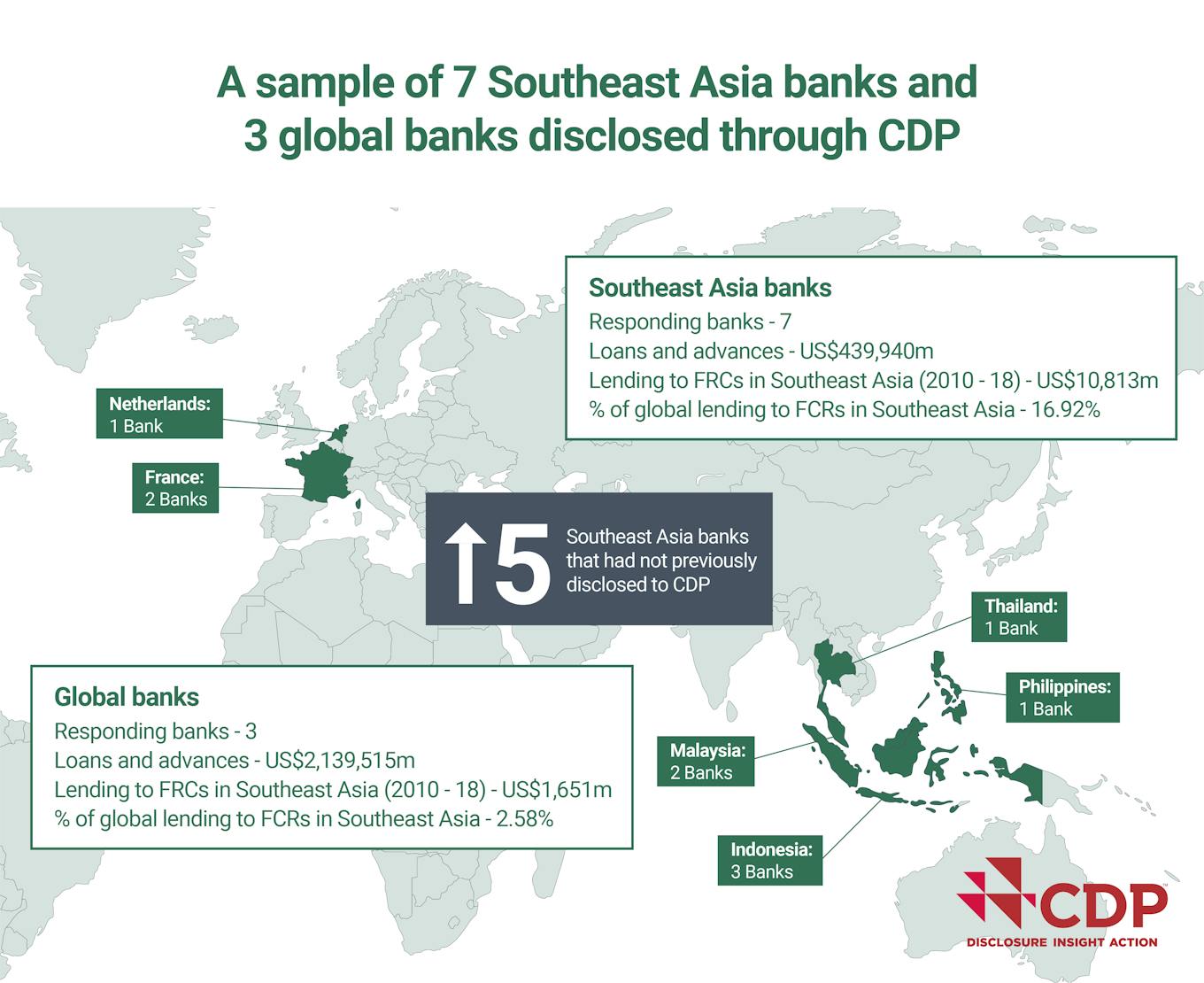

The leading 20 Singaporean, Malaysian and Indonesian banking institutions alone represented 37 for every cent or US$23 billion of total worldwide lending to the region’s FRC sector among 2011 and 2018.

“

Threats do not occur from just one-off gatherings and will present ongoing threats above the medium-to-long term. Except more regimen and suitable hazard assessment is carried out, the uncertainty above the severity of these impacts will continue on to loom substantial, complicating the actions desired to mitigate the economic, social and environmental consequences.

Policymakers collectively with banking institutions in the region for that reason have the crucial usually means to address forest and weather pitfalls to speed up the change in direction of sustainable techniques inside of the FRC sector.

As a commence, policymakers can strive to superior recognize and mitigate systemic pitfalls to direct economic establishments on how this can be done.

Measuring the economic threats from local weather modify and forest reduction

As policymakers get started to take stock of these dangers an inherent challenge stays, the financial and company implications of local climate modify, forest reduction and land use transform might not be immediately clear, conveniently calculated or modelled.

A lot of chance-modeling techniques deployed by banking institutions are fashioned on historic tendencies, which might neglect the evolving character of forest and climate threat and are unsuccessful to seize the full-scale impact in their estimates.

To superior understand and articulate the marriage involving FRC efficiency and borrowers’ credit worthiness, we have applied a novel approach regarded as Dynamic Possibility Evaluation (DRA), which builds on a two-dimensional tactic to possibility administration, setting up a community of challenges determined in interviews with gurus in FRCs and finance industries.

In the a short while ago revealed “Forest Commodity Finance: Implications for Southeast Asia’s Coverage Makers” coverage briefing, we observed 19 specific risks applicable to finance and manufacturing of FRCs in Southeast Asia. From these, 4 clusters of danger themes arise: political situations, focus threat, shopper sentiment, and fire risk.

Finance plays a crucial function in providing a forest-favourable upcoming. Money establishments can catalyse alter by participating with the firms they lend to, invest in and insure. Graphic: CDP

If merged, these possibility teams can have substantive effect on the forest commodities market and the economic sector. Fireplace risk alone has the possible to have an impact on FRC producers’ income by 24 for each cent, although the Concentration Hazard cluster can reduce profits by 22 for each cent inside a interval of 33 months.

Dangers do not crop up from a person-off functions and will existing ongoing threats in excess of the medium-to-lengthy expression. Unless of course additional routine and acceptable danger evaluation is carried out, the uncertainty about the severity of these impacts will proceed to loom large, complicating the steps required to mitigate the economic, social and environmental repercussions.

As both equally nearby and international monetary institutions make investments and lend extensively to the Southeast Asian FRC sector, specially palm oil, it is essential to address their role in financing deforestation and land use modify, as well as how the affiliated risks impact their portfolios, and possibly the region’s economic steadiness.

Additional specific policies for better forest and local climate management

By wanting at systemic hazards and their scale extra intently, a lot more focused plan steps can be applied to de-possibility the monetary sector through improved forest and local weather management.

Centered on the insights from our assessment, CDP suggests four quick actions for policymakers and regulators to accelerate the shift in direction of sustainable methods inside of the FRC sector.

The initially move is to endorse detailed and clear forest and weather associated disclosures.

This will allow for much better decision-earning, checking and evaluation of threats. Improved disclosures and owing diligence practices offer you an prospect to make much better details readily available to stakeholders and to tell locations for collaboration that will enhance environmental effectiveness.

Regulators really should consider mandating the tips of the Undertaking Power on Climate-linked Money Disclosures (TCFD), which gives a effectively-recognised foundation for the disclosure of local weather dangers.

In addition, the Science Dependent Targets initiative (SBTi) has not too long ago released their fiscal sector advice and will before long launch a complement to guidance forest, land and agriculture focus on setting for the FRC sector and people funding it.

It is also significant to guarantee forest and local weather threats are assessed holistically. Policymakers should analyse the systemic (or community-huge) vulnerability and affect details to entirely handle the dynamic and interconnected character of forest and climate change threat.

Being familiar with which teams of risks are extra probable to materialise and how fast these risks will pose effects as soon as brought on can enable policymakers strategise a clearer course for helpful action.

With a deeper, additional complete comprehension of the systemic pitfalls, policymakers can then apply targeted policy steps to mitigate and prevent the threats from materialising.

To this conclusion, we present a facts dashboard of probable knowledge sources in our Forest Commodity Finance plan brief that can be utilized to monitor the emergence of person risks. The indicators may possibly also be useful for monitoring the effectiveness of hazard-mitigating interventions in excess of time.

We get in touch with on policymakers and economic institutions to recognise and mitigate the inherent environmental and social hazards that exist in the FRC sector.

Extensive disclosures that empower monitoring and checking business methods will be critical to the two catalyzing a sustainable observe in the region’s FRC sector and making certain the region’s prolonged time period financial, social and environmental viability.

Pratima Divgi is Regional Director of Hong Kong at CDP.

Thanks for looking through to the close of this tale!

We would be grateful if you would contemplate joining as a member of The EB Circle. This can help to continue to keep our stories and sources no cost for all, and it also supports independent journalism focused to sustainable improvement. For a small donation of S$60 a yr, your enable would make this kind of a major big difference.

Find out more and be a part of The EB Circle