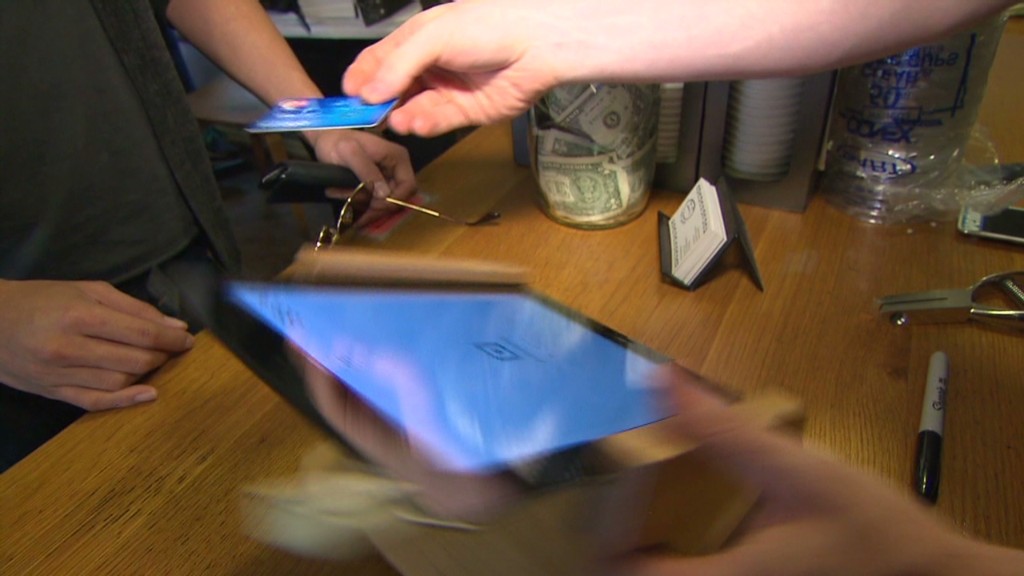

This code hacks nearly every credit card machine in the country

Get completely ready for a facepalm: 90% of credit history card audience at this time use the exact password.

The passcode, set by default on credit card machines since 1990, is effortlessly observed with a fast Google searach and has been exposed for so very long there is certainly no sense in trying to cover it. It is both 166816 or Z66816, relying on the equipment.

With that, an attacker can gain entire command of a store’s credit score card viewers, potentially making it possible for them to hack into the devices and steal customers’ payment facts (imagine the Target (TGT) and Home Depot (Hd) hacks all about yet again). No ponder significant shops continue to keep getting rid of your credit score card data to hackers. Protection is a joke.

This newest discovery will come from researchers at Trustwave, a cybersecurity firm.

Administrative entry can be used to infect equipment with malware that steals credit card facts, stated Trustwave executive Charles Henderson. He comprehensive his results at very last week’s RSA cybersecurity conference in San Francisco at a presentation called “That Stage of Sale is a PoS.”

Choose this CNN quiz — discover out what hackers know about you

The problem stems from a recreation of very hot potato. Device makers sell machines to exclusive distributors. These sellers provide them to stores. But no one thinks it really is their position to update the learn code, Henderson told CNNMoney.

“No just one is shifting the password when they established this up for the to start with time all people thinks the safety of their point-of-sale is another person else’s accountability,” Henderson claimed. “We’re producing it quite simple for criminals.”

Trustwave examined the credit rating card terminals at extra than 120 stores nationwide. That contains main clothing and electronics outlets, as very well as neighborhood retail chains. No precise vendors had been named.

The vast greater part of devices were designed by Verifone (Spend). But the very same concern is existing for all significant terminal makers, Trustwave mentioned.

A spokesman for Verifone claimed that a password alone is just not adequate to infect machines with malware. The firm reported, until now, it “has not witnessed any assaults on the security of its terminals based on default passwords.”

Just in case, nevertheless, Verifone mentioned merchants are “strongly recommended to improve the default password.” And these days, new Verifone devices arrive with a password that expires.

In any circumstance, the fault lies with stores and their unique suppliers. It is like dwelling Wi-Fi. If you purchase a household Wi-Fi router, it really is up to you to improve the default passcode. Retailers must be securing their have machines. And equipment resellers really should be helping them do it.

Trustwave, which assists protect vendors from hackers, explained that maintaining credit rating card machines safe and sound is very low on a store’s list of priorities.

“Firms commit far more money selecting the coloration of the issue-of-sale than securing it,” Henderson reported.

This dilemma reinforces the conclusion built in a the latest Verizon cybersecurity report: that shops get hacked due to the fact they’re lazy.

The default password matter is a significant difficulty. Retail laptop or computer networks get uncovered to laptop or computer viruses all the time. Take into consideration 1 situation Henderson investigated recently. A awful keystroke-logging spy application finished up on the laptop a keep takes advantage of to method credit card transactions. It turns out workers experienced rigged it to participate in a pirated version of Guitar Hero, and unintentionally downloaded the malware.

“It demonstrates you the amount of access that a great deal of individuals have to the place-of-sale natural environment,” he claimed. “Frankly, it is really not as locked down as it must be.”

CNNMoney (San Francisco) Initial posted April 29, 2015: 9:07 AM ET